Autocorrelated Series – Application

Menghan Yuan

May 10, 2025

This script provides an example of autocorrelated residuals.

Dataset description

US Macroeconomics Data Set, Quarterly, 1950I to 2000IV, 204 Quarterly Observations

Source: Department of Commerce, BEA website and www.economagic.com

| Feild Name | Definition |

|---|---|

| year | Year |

| qtr | Quarter |

| realgdp | Real GDP ($bil) |

| realcons | Real consumption expenditures |

| realinvs | Real investment by private sector |

| realgovt | Real government expenditures |

| realdpi | Real disposable personal income |

| cpi_u | Consumer price index |

| M1 | Nominal money stock |

| tbilrate | Quarterly average of month end 90 day t bill rate |

| unemp | Unemployment rate |

| pop | Population, mil. interpolate of year end figures using constant growth rate per quarter |

| infl | Rate of inflation (First observation is missing) |

| realint | Ex post real interest rate = Tbilrate - Infl. (First observation is missing) |

# data preview

data <- read.table("https://raw.githubusercontent.com/my1396/course_dataset/refs/heads/main/TableF5-2.txt", header = TRUE)

data <- data %>%

mutate(delta_infl = infl-lag(infl))

data %>%

head() %>%

knitr::kable(digits = 5) %>%

kable_styling(bootstrap_options = c("striped", "hover"), full_width = FALSE, latex_options="scale_down") %>%

scroll_box(width = "100%")| Year | qtr | realgdp | realcons | realinvs | realgovt | realdpi | cpi_u | M1 | tbilrate | unemp | pop | infl | realint | delta_infl |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1950 | 1 | 1610.5 | 1058.9 | 198.1 | 361.0 | 1186.1 | 70.6 | 110.20 | 1.12 | 6.4 | 149.461 | 0.0000 | 0.0000 | |

| 1950 | 2 | 1658.8 | 1075.9 | 220.4 | 366.4 | 1178.1 | 71.4 | 111.75 | 1.17 | 5.6 | 150.260 | 4.5071 | -3.3404 | 4.5071 |

| 1950 | 3 | 1723.0 | 1131.0 | 239.7 | 359.6 | 1196.5 | 73.2 | 112.95 | 1.23 | 4.6 | 151.064 | 9.9590 | -8.7290 | 5.4519 |

| 1950 | 4 | 1753.9 | 1097.6 | 271.8 | 382.5 | 1210.0 | 74.9 | 113.93 | 1.35 | 4.2 | 151.871 | 9.1834 | -7.8301 | -0.7756 |

| 1951 | 1 | 1773.5 | 1122.8 | 242.9 | 421.9 | 1207.9 | 77.3 | 115.08 | 1.40 | 3.5 | 152.393 | 12.6160 | -11.2160 | 3.4326 |

| 1951 | 2 | 1803.7 | 1091.4 | 249.2 | 480.1 | 1225.8 | 77.6 | 116.19 | 1.53 | 3.1 | 152.917 | 1.5494 | -0.0161 | -11.0666 |

Empirical model

\[ \Delta I_t = \beta_1 + \beta_2 u_t + \varepsilon_t \] where

- \(I_t\) is the inflation rate; \(\Delta I_t = I_t - I_{t-1}\) is the first difference of the inflation rate;

- \(u_t\) is the unemployment rate;

- \(\varepsilon_t\) is the error term.

We remove the first two quarters due to missing value in the first observation and the change in the rate of inflation.

Regression result for OLS.

lm_phillips <- lm(delta_infl ~ unemp, data = data %>% tail(-2))

stargazer(lm_phillips,

type = "html",

title = "Phillips Curve Regression",

notes = "<span>*</span>: p<0.1; <span>**</span>: <strong>p<0.05</strong>; <span>***</span>: p<0.01 <br> Standard errors in parentheses.",

notes.append = F)| Dependent variable: | |

| delta_infl | |

| unemp | -0.090 |

| (0.126) | |

| Constant | 0.492 |

| (0.740) | |

| Observations | 202 |

| R2 | 0.003 |

| Adjusted R2 | -0.002 |

| Residual Std. Error | 2.822 (df = 200) |

| F Statistic | 0.513 (df = 1; 200) |

| Note: |

*: p<0.1; **: p<0.05; ***: p<0.01 Standard errors in parentheses. |

# variance-covariance matrix

vcov(lm_phillips)## (Intercept) unemp

## (Intercept) 0.54830829 -0.08973175

## unemp -0.08973175 0.01582211Autocorrelated residuals

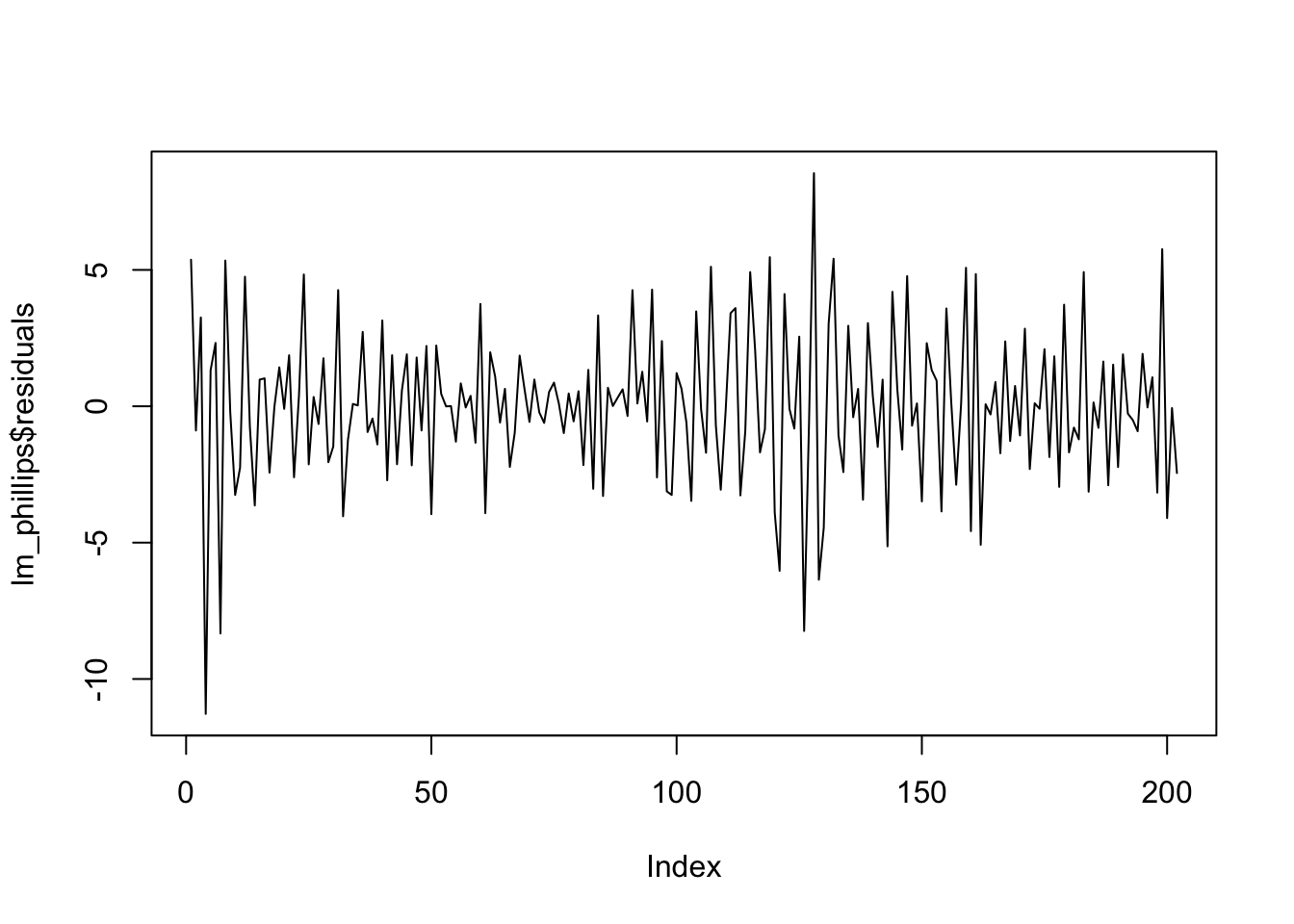

Plot the residuals.

plot(lm_phillips$residuals, type="l")

Fig. 1: Phillips Curve Deviations from Expected Inflation

Fig. 1 shows striking negative autocorrelation.

Now we test the serial correlation of the residuals. \[ \varepsilon_t = \phi\varepsilon_{t-1} + e_t \]

res <- tibble(

res_t = lm_phillips$residuals,

res_t1 = lag(lm_phillips$residuals))

lm_res <- lm(res_t ~ res_t1, data = res)

summary(lm_res)##

## Call:

## lm(formula = res_t ~ res_t1, data = res)

##

## Residuals:

## Min 1Q Median 3Q Max

## -9.8694 -1.4800 0.0718 1.4990 8.3258

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -0.02155 0.17854 -0.121 0.904

## res_t1 -0.42630 0.06355 -6.708 2e-10 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 2.531 on 199 degrees of freedom

## (1 observation deleted due to missingness)

## Multiple R-squared: 0.1844, Adjusted R-squared: 0.1803

## F-statistic: 44.99 on 1 and 199 DF, p-value: 2.002e-10The regression of the least squares residuals on their past values gives a slope of -0.4263 with a highly significant \(t\) ratio of -6.7078. We thus conclude that the residuals in this models are highly negatively autocorrelated.

References:

- Ex. 12.3, Chap 12 Serial Correlation, Econometric Analysis, Greene 5th Edition, pp 251.